The release of a number of reports by the federal Romanow Commission has exposed its two-pronged public relations strategy: First, deny that there is a problem. Second, tag the provinces (especially Alberta) as the bad guys in health-care reform.

This strategy adds urgency to health reforms now being considered in Alberta.

The first report released by the commission provided the outcome of 12 focus groups conducted by the Canadian Policy Research Network, a think-tank that gets millions of dollars in funding from the federal government.

According to the commission’s news release, the conclusions reached by the focus groups were “consistent across all 12 sessions.”

Their surprising unanimity can be summarized as follows — raise taxes to pay for a health-care system that is little changed from today.

Two weeks later, the commission released a study with the conclusion that “the evidence of a fiscal crisis in health care in Canada is not evident,” and further stated that there is “no empirical evidence” that Canadians are over-taxed.

These commission-commissioned studies, while they do accord with Romanow’s earlier comments that he is “not convinced” there is a fiscal crisis in health care, fly in the face of nearly every other government commissioned report on health care — from Quebec’s Claire report, to Alberta’s Mazankowski report and even federal Liberal Senator Michael Kirby’s recent examination of health care.

It was hardly a surprise, then, that the commission released another study with the following, conclusion: “The alternatives proposed by Quebec and Alberta target the methodical dismantling of the most important public services accomplishment in Canada.”

This conclusion was reached by invoking a false dichotomy between Ottawa’s Canada Health Act which ensures “that all citizens have the same right to access health care based on need” on the one hand, and Quebec and Alberta’s so-called goal of “erecting conditions favourable to the delivery and funding of services by private enterprise” on the other.

It must have just slipped the author’s attention that a large part of the current medicare system is delivered and funded by doctors who operate on a for-profit basis, or that Alberta has sworn full allegiance to the Canada Health Act, going so far as to entrench it into provincial legislation.

The commission’s approach can therefore be summarized as: Status quo good, provinces bad.

This approach lends additional urgency to reform efforts underway in the provinces — especially those in Alberta.

The final Romanow report is not due until November of this year. That gives Alberta a very small window to entrench its reforms, to lead rather than to follow and to provide all Canadians with hope that health care will be available and sustainable as our population begins to age.

Alberta has a blueprint for reform in its Mazankowski report. The provincial government has accepted all its recommendations in principle, though all it has really done so far is to raise health-care premiums (something the Romanow studies should be applauding — higher taxes for health care).

Alberta should, therefore, announce that it will implement the most important reform in the Mazankowski report — the establishment of some sort of co-payment system for health services, utilizing the dollars that citizens already pay in health premiums.

The changes are easy enough to implement. Albertans (poorer citizens are subsidized) already pay health premiums to the provincial government.

Instead of merely dumping these premiums into general revenues, a simple accounting change should be made so that the money remains in an account for each Albertan.

The next step would be to outline a list of services for which there would be a basic charge that would come from the account.

This should probably include all routine costs, such as doctor visits as well as emergency ward trips, minor surgeries, etc. The initial charges do not necessarily need to match the exact costs of these services (which, in truth, we do not know, as there are no prices to convey this information), but will come to do so over time.

The critical change is to get Albertans to start seeing the financial impact of their use of the health-care system.

And all of this can be done without increasing the private delivery or funding that exists today.

There are some wrinkles to iron out. For example, how to deal with any unused funds in the account — whether Albertans should pay the full cost of services over a small range if their account becomes depleted, after which full provincial funding takes over and the list of which services are to be charged against the account.

But none of these wrinkles should prevent Alberta from introducing such accounts before Romanow’s November deadline.

For that is the critical political objective. Following Romanow’s report in November, Ottawa’s public relations machine will be whipped up to hammer home its “don’t worry, be happy” mantra about health-care sustainability, along with the simultaneous “be worried, don’t be happy” mantra about provincial efforts at real reform of health care.

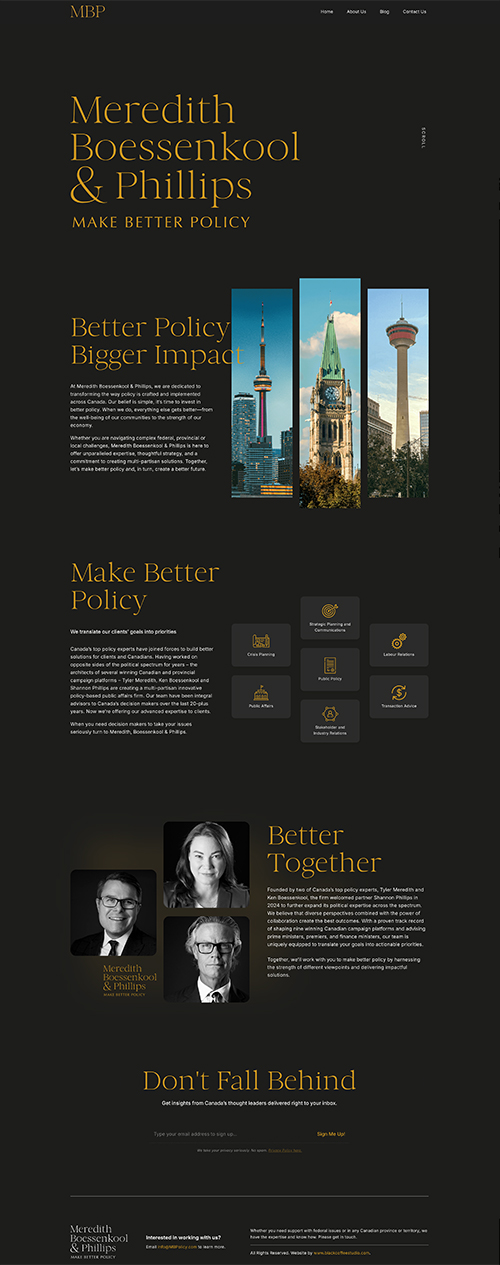

Ken Boessenkool is president of Sidicus Consulting Ltd. in Airdrie. He is also an adjunct research fellow at the C.D. Howe Institute.

Idnumber: 200208060085 Edition: Final Story Type: Business; Opinion Length: 848 words Keywords: HEALTH CARE; MEDICARE; ALBERTA; CANADA; RECOMMENDATIONS; REPORTS Illustration Type: Graphic, Diagram Illustration: Graphic: (See hard copy for illustration).

How to reduce poverty in Canada National Post Wednesday, July 31, 2002 Page: A17 Section: Editorials Byline: Ken Boessenkool Source: National Post

The National Council of Welfare did the country a great service this week by releasing its annual Poverty Profile. It is a wealth of statistics that show, among other things, that the reduction in poverty during the mid- and late 1990s occurred primarily in two provinces — Alberta and Ontario. It was a bit surprising, however, that in its analysis and public discussion, the Council neglected to mention that these reductions in poverty coincide nicely with welfare reform in these two provinces.

Let’s start with Alberta. It began its welfare reforms in 1993. It lowered welfare rates, restricted welfare eligibility, and severely tightened the administration of welfare by removing all discretion from front-line welfare workers. The resulting drop in welfare use was astounding. The percentage of the population on welfare dropped from 7% of Albertans in 1992 to 2% by 1999, where it has remained.

The data in the Council’s recent report shows what happened to low-income Albertans over this period. The number of Albertans living below Statistics Canada’s Low Income Cut-offs (or LICO, which the Council calls a poverty line, despite the fact that Statistics Canada does not approve of its use in this way) dropped by more than five percentage points in Alberta between the year before the reforms and 1999. This compares with a drop of less than one percentage point for the country as a whole over the same period.

Now move to Ontario. A big part of the Harris government’s Common Sense Revolution was welfare reforms. They reduced welfare rates and implemented a massive program of workfare. While they focussed less on administrative reforms, and continue to spend much more per welfare recipient than other provinces, the results were modestly impressive. Welfare use fell from 12% of the population to 8% in 1999, and 7% today.

The National Council of Welfare railed against these changes. It worried that the Ontario reforms created “a system that further entrenches poverty” and reversed “the host of improvements in the welfare system made by previous Liberal and New Democratic Party governments.” The Council failed to note that the Liberal and New Democratic changes resulted in driving up the number of Ontarians on welfare to an unprecedented 13% of the population, and also increased the number of Ontarians living in poverty (to use the Council’s wording).

The Council’s recent Poverty Profile shows that the number of people living below the LICO in Ontario fell by more than two percentage points following the Harris workfare reforms. Again, this drop was larger than the drop experienced in the rest of the country over the same period.

Perhaps the most interesting way to look at poverty reduction during the 1990s is to consider what would have happened had poverty not fallen so much in Alberta and Ontario during the mid- to late 1990s. The answer takes a little fiddling with the numbers, but it turns out that without the reduction in poverty in Alberta and Ontario, Canada would have seen an increase, not a decrease, in the number of Canadians living in poverty during this period.

In other words, the economic recovery over that period did little to reduce the number of low-income Canadians. The reduction in the number of low-income Canadians was concentrated in provinces that implemented some combination of lower welfare benefits, stricter eligibility rules, tightened administration and workfare. The provinces that did some or all of these (Saskatchewan could be added to this list) were responsible for all of the reduction in the number of low-income Canadians that occurred in the late 1990s.

The failure of the Council to highlight these successful poverty reduction strategies can be seen in recent statements made by the Alberta and Ontario governments. The post-Harris regime has promoted increasing welfare rates that are still generous compared to the rest of the country. Alberta rejected a report recommending welfare rate increases on the tepid grounds that the province “couldn’t afford them.” Instead, both governments should be promoting, and continuing, their welfare reforms as poverty reduction strategies. A properly attentive National Council of Welfare should be providing them with the fodder to do so.

The federally funded Council states that its goal is to examine and inform Canadians and governments on “social and related programs and policies which affect low-income Canadians.” It is to the detriment of low-income Canadians from coast to coast that the Council ignores the important welfare reforms in Alberta and Ontario that did so much to reduce poverty in those provinces.

Idnumber: 200207310147 Edition: National Story Type: Opinion Note: Ken Boessenkool heads a Calgary-based economic and public policy consulting firm and is an adjunct research fellow at the C.D. Howe Institute. Length: 747 words Keywords: SOCIAL WELFARE; POVERTY; REPORTS; REFORM; CANADA Company: National Council of Welfare

Equalization: the help that hurts National Post Tuesday, June 25, 2002 Page: A19 Section: Editorials Byline: Ken Boessenkool Source: National Post

The federal equalization program — which distributes dollars to poorer provinces based on their ability to raise revenues — is rather simple in theory and noble in intent. According to the Canadian Constitution, equalization exists to “ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.” In practice, however, equalization is exceedingly complex and some of the incentives it creates are far from noble. In short, equalization appears to be help that hurts.

For at least 30 years, we policy wonks have built economic models showing equalization creates incentives for less-developed provinces to raise their taxes. By manipulating their own tax rates, in theory poorer provinces can affect the size of their equalization payment, and get partially compensated for the debilitating effects of those higher taxes.

But until now, no one has actually checked the evidence to see whether this prediction about equalization’s perverse incentives is actually borne out by the facts. Well, the verdict is in: There is strong evidence that equalization does, in fact, encourage poorer provinces to overtax their population. Start with the evidence about tax rates. The burden of personal income taxes in poorer provinces is, on average, one-third higher than in richer provinces (British Columbia, Alberta and Ontario). Capital taxes in poorer provinces are more than two times higher than in the rich provinces; sales taxes are half-again as high; and fuel taxes are one-tenth to three-fifths higher. Even if you take low-tax Alberta out of the calculation, and compare taxes in the equalization-receiving provinces only with those in Ontario and British Columbia, the conclusion still holds.

Now the wonks not only predicted that taxes would be higher in recipient provinces; they also foresaw two other effects of equalization on taxes. First, they predicted that the bigger the province, the stronger the incentives would be — i.e. these incentives should be stronger for Quebec (the largest recipient) than for the Atlantic Provinces. Second, they predicted there would be a perverse incentive to levy higher tax rates on weaker tax bases (those tax bases most likely to shrink under the burden of heavy taxation) and lower tax rates on stronger tax bases (those more resistant to the effects of heavy taxes).

The evidence supports both predictions — tax rates in Quebec are generally higher than tax rates in Manitoba and Saskatchewan, which are in turn higher than in the Atlantic provinces. To take but one example, average personal income tax rates as measured by Ottawa’s equalization calculations, are more than 43% higher than the national average in Quebec, 18% higher in Manitoba and Saskatchewan and 16% higher in the Atlantic provinces. Recipient provinces also show evidence of levying higher tax rates on relatively weak tax bases, and lower tax rates on relatively stronger tax bases.

These findings are striking, for they confirm not only that the constitutional imperative to ensure “comparable tax rates” is not working, but that the predictions of the theorists about equalization’s perverse incentives are precisely mirrored in the real world. In short, equalization rewards recipient provinces for imposing high and damaging tax rates. For far too long, proponents of equalization have dismissed such concerns about perverse incentive effects as ivory tower analysts having too much fun with economic models. They were only partly right (we do have fun with our models). It will now be much more difficult to play down these incentive effects in the face of this empirical support.

Of particular interest is the fact that the highest tax rates in recipient provinces tend to be on personal income and, to a slightly lesser extent, taxes on consumption. In other words, the perverse effects seem to be showing themselves most strongly via taxes on people.

These higher tax rates that are a result of equalization’s perverse incentives threaten to derail a prosperous future for Canada’s poorer provinces. At a time when human capital is one of the most important keys to growth in an increasingly globalized and technologically dependent world, these incentives ought to worry all Canadians who are concerned with the future of our more economically dependent regions. These regions have faced enough challenges in the past, and in the present, without the noble intentioned equalization program creating further perverse results.

Moreover, Canada’s wealthier provinces have clearly chosen a low-tax model as the basis for their future growth, and are in competition to lower tax rates. That means that the provinces most in need of growth, the equalization recipients, are now being rewarded for keeping their tax rates too high, as the wealthier provinces drop their taxes to make themselves a magnet for investment and jobs. Such a policy is almost guaranteed to keep the poorer provinces poor and to make dependence on transfers a permanent feature of Canada’s policy landscape.

This opens up a new challenge, namely, how might equalization be reformed to reduce these perverse incentives. That work must now proceed if Canadians who live in recipient provinces are to be relieved from the excess tax burdens that equalization’s incentives appear to be producing. All Canadians have a stake in ensuring that we stop providing help that hurts.

Idnumber: 200206250141 Edition: National Story Type: Business; Opinion Note: Ken Boessenkool is the president of a Calgary-based economic and public policy consulting company, an Adjunct Research Fellow at the C.D. Howe Institute and the author of Taxing Incentives: How Equalization Distorts Tax Policy in Recipient Provinces, published by the Atlantic Institute for Market Studies. Length: 861 words Keywords: GOVERNMENT FINANCE; FEDERAL PROVINCIAL FINANCES; TAXATION; REPORTS; CANADA

Boosting Alberta’s resource reserves will cushion baby boom bust Calgary Herald Sunday, May 26, 2002 Page: D9 Section: Business Byline: Kenneth J. Boessenkool Source: For The Calgary Herald

Any discussion of Alberta financial management must come to grips with the central role of resources revenues and the future financing of health and pensions.

First, a quick review of Alberta’s revenues.

In the past two decades, revenues from income taxes have followed a more-or-less upward trend. Recent substantial tax cuts on both the personal and corporate side have interrupted this upward trend, but only temporarily.

Other revenues have been basically stable over the past few decades, with the exception of recent jumps in health care premiums and cigarette taxes, should continue to remain fairly stable in the future.

Alberta’s resource revenues have exhibited neither growth nor stability. In the past four years they have fluctuated between $2.5 and $10.8 billion. Over the past two decades, they have made up as little as 15 and as much as 40 per cent of Alberta’s budgetary revenues.

A revenue source that fluctuated between 15 and 40 per cent of total revenues would strain all but the best of administrations.

Non-renewable resource royalties are of a fundamentally different nature from other types of revenues, and therefore should not properly be considered revenues like income taxes, sales taxes or other revenue sources.

When oil or gas is sold all that happens is that a physical asset has been converted into a financial asset. The proceeds from the sale of oil or gas are not properly income — they are the proceeds from the sale of an asset, and royalties that the provincial government collects are Albertans’ share of that asset.

Treating resource revenue as the proceeds from the sale of an asset was at least part of the explanation for diverting some of this money into the Alberta Heritage Savings Trust Fund in the ’70s and ’80s and for paying down its debt in the 1990s. In the former case, the Alberta government used resource revenues to build up an asset — a nest egg, if you will — and in the latter case it reduced a liability.

In the early 1990s, the Alberta government substantially reduced its reliance on resource revenues to fund regular program spending — which is why it still ran a surplus when resource revenues fell to $2.5 billion in 1998/99. More recently, that has changed. The Alberta government has increased substantially its reliance on natural resource revenues to fund regular program expenditures. If resource revenues fell to $2.5 billion this year, the Alberta government would run a substantial deficit.

This is unsustainable from an historic perspective, and wrong from an economic perspective.

From an historic perspective the current reliance on resource revenues is higher than at any point since the provincial budget was balanced. The Alberta government’s current reliance on resource revenues is worryingly reflective of its dependence on resource revenues during the 1980s.

From an economic perspective, the Alberta government should not be relying on resource revenues to sustain current program spending to this extent. In fact, since resource royalties are not properly income, they should not be used to fund current expenditures at all — doing so is a bit like selling your house to buy food.

William Robson of the C.D. Howe Institute has calculated a health care liability of $20,000 per Albertan or $60 billion dollars. Another way to look at this liability is to say: If the Alberta government wanted to keep its taxes stable, it could only meet rising health expenditures in the next 40 years if it had a $60-billion nest egg yielding a six per cent return. But it would have to have that nest egg today.

If there is to be any hope of meeting the funding needs of health care, the Alberta government is going to have to find a way to get through the coming baby-boomer bulge. And if the Alberta government wants to do that without raising taxes or planning for large deficits, it must set aside some money today — in short, it needs to start building that $60-billion nest egg.

Turning to pensions, the 2000 Alberta budget contains the following passage:

“. . . as a result of Alberta’s younger population and high employment rates, it could likely deliver a pension plan identical to the CPP with somewhat lower contribution rates.”

How much lower? The budget states that an Alberta Pension Plan could deliver benefits equivalent to the CPP with a contribution rate somewhere between 7.8 and 9.1 per cent, compared to 9.9 percent for the CPP. That’s a 10 to 20 per cent payroll tax cut.

The Alberta government could unilaterally opt out of the CPP using the CPP Act’s three years notice provision.

But one of the key issues in setting up an Alberta Pension Plan is the unfounded liability that the Alberta government would inherit from the CPP.

In once sense this is a red herring, since, as a co-sponsor of the CPP, Alberta already carries its portion of the liability.

Still, the liability is substantial. The present CPP unfounded liability amounts to $19,900 per Canadian. Alberta’s demographic and labour force advantages would mean an Alberta Pension Plan would have a liability that is slightly less.

The CPP is currently prefunding some of its future obligations by expanding the size of the investment fund through higher contribution rates. It is doing what Robson proposes to do for health — building a nest egg today to cap future contribution rates.

The common thread in this discussion of health and pensions is the idea of prefunding — building up a nest egg today to limit future tax increases.

And where might that nest egg come from? If resource revenues should be treated as a capital asset, this means they should be set aside in a capital account, not spent as if they were part of current revenues. And if the Alberta government treated its resource revenues in this way, that capital account would provide the prefunding necessary to start building nest eggs for health and pensions.

In summary, the government of Alberta should move towards funding current spending out of revenues excluding resource royalties. Resource royalties should be put aside to build up a nest eggs so that health care and pensions can be funded with minimal future tax increases or deficits.

Alberta is uniquely positioned in that it has a capital asset — oil and gas in the ground — that it can convert into a financial asset — a nest egg — that can be used to minimize sizeable future tax increases or deficits that are all but certain if the Alberta government is meet the funding needs of fund health care and pensions as the baby boomers age.

Setting resource revenues aside today will make it more likely that the baby boomers will not bust the health budget, as well as ensuring that younger generations are not forced to pay tax rates for health and pensions that are even more punishing than they are today.

Idnumber: 200205260004 Edition: Final Story Type: Business; Opinion Note: Kenneth J. Boessenkool is an Adjunct Research Fellow C.D. Howe Institute. Length: 1154 words Keywords: GOVERNMENT FINANCE; NATURAL RESOURCES; ALBERTA Illustration Type: Black & White Photo Illustration: Photo: Herald Archive, Edmonton Journal / Alberta has increased its reliance on natural resource revenues to fund regular program expenditures. If resource revenues fell to $2.5 billion this year, the government would run a substantial deficit.

What the poverty industry won’t tell you National Post Friday, May 24, 2002 Page: A19 Section: Editorials Byline: Ken Boessenkool Column: In Calgary Dateline: CALGARY Source: National Post

CALGARY – Alberta’s poverty industry is at it again. A recently concluded review of Alberta’s welfare program saw the usual suspects trot out their heart-wrenching, single-mother-on-welfare anecdotes along with laments about welfare rates that are too low, affordable housing that is inadequate, medical coverage that is poor and child care that is in short supply.

Despite all this, the Alberta government decided not to raise Alberta welfare rates or introduce other massive changes, because, “sorry folks, we just don’t have the money.”

It was the right decision, of course, but for the wrong reasons. For the fact of the matter is that the Klein Conservatives have a remarkable story to tell about the success of their welfare reform measures. And to tell that story, you must get beyond heart-wrenching anecdotes and pore over the raw data.

In the beginning (for Alberta, that was 1993), 7% of Alberta’s population was on welfare and 14% fell below Statistics Canada’s Low Income Cut-Offs (LICO), measured after taking into account all taxes and government transfers. Its welfare program was poorly administered, benefits were too generous and growing numbers of young people were getting trapped in a cycle of dependency — almost half of recipients were single, and about two-thirds were under 34 years old).

Today, the percentage of Albertans on welfare has dropped to 2%. The most recent measure (1998) of the number of Albertans living below the LICO — again, after taking into account taxes and the now reduced government transfers — has fallen to 12.5%, a drop that is two-and-a-half-times larger than the drop in Canada as a whole over the same period.

These are impressive numbers, but they do not tell the entire story. The real story is what happened to those individuals who no longer relied on welfare to pay the bills. That answer is found in a remarkable set of data recently drawn out of the 1996 Census by C.D. Howe Fellow John Richards.

Richards compared labour force data in the cities of Calgary and Edmonton to Winnipeg, Regina, Saskatoon, Toronto and Montreal. He found that employment rates in Alberta were more than seven percentage points higher, and unemployment rates were 2.1 percentage points lower, than in these other cities.

Even more interesting, Richards dug down to the neighbourhood level, and divided neighbourhoods into poor and non-poor neighbourhoods. He found that Alberta’s employment rate in poor neighbourhoods was 8.5 percentage points higher, and unemployment rates 4.7 percentage points lower, than in other Canadian cities.

These results bolster earlier findings that showed that a large proportion of the reduction in welfare use came from preventing young (below 34) Albertans from getting onto welfare, and, more importantly, that the increase in employment rates for these same individuals was large enough to explain the reduction in welfare roles. In short, earlier evidence suggested that Alberta had discovered the most impressive job-creation program for youth that the country had ever seen. The twist that Richards has added is that Alberta has found the most impressive job creation program for poor youth that the country has ever seen.

And, just to placate the critics, it wasn’t the economy which did the job. Economic growth in Alberta following the 1993 welfare reforms was weaker than economic growth during the late 1980s. Yet during the late 1980s, the number of welfare recipients in Alberta increased.

Alberta’s success at welfare reform is all the more impressive when you compare it to similar efforts elsewhere. Ontario had 11% of its population on welfare in 1995 when it initiated its own reforms. It now has 7% on welfare — the level Alberta started with in 1993, and equal to the current national average. And Ontario’s reforms have been very expensive — workfare costs money, and Ontario has left its very generous disability program largely intact. According to data collected by Ottawa, Ontario spends 40% more per welfare client than Alberta does: $5,660 per individual versus $4,050 in Alberta (which is still higher than the national average of just under $4,000).

Alberta’s 1993 welfare reform is a true and lasting example of what is now called compassionate conservatism. Before the Americans ended “welfare as we know it,” Alberta conservatives were putting it into practice.

The only real shame is that they seem so reluctant to defend this legacy. Alberta should not maintain the welfare status quo because they have no money, but because of the remarkable success of a welfare reform package that has resulted in poorer, younger Albertans getting back to work.

Idnumber: 200205240185 Edition: National Story Type: Business; Opinion Note: Ken Boessenkool heads up a Calgary-based economic and public policy consulting company and is an Adjunct Research Fellow at the C.D. Howe Institute. Length: 752 words Keywords: POVERTY; SOCIAL WELFARE; LOBBYING; STATISTICS; CANADA

Good firewalls make good policy National Post Friday, May 3, 2002 Page: A19 Section: Editorials Byline: Ken Boessenkool Source: National Post

A well-designed computer network, like well-designed policy in a federation like Canada, depends on good firewalls. In a computer network, a good firewall alerts users to potential harmful interactions between the computer and the local network, and also between the local network and the Internet. Similarly, policy in a federation works better when firewalls limit potentially harmful intrusions by higher or external governments, or between governments and transnational organizations.

Good firewalls do not prevent any and all interaction — rather, they limit unwanted intrusions that have the potential to cause damage. Firewalls can be configured to allow healthy interaction with networks and other computers (e-mail, surfing, exchanging files with known parties), but they also alert the computer user or network — usually via a pop-up window — of anything unpleasant.

For example, my home has a network of two computers — one for the kids and one for the adults. A first firewall alerts me when the network tries to access my files or tries to use my computing power for, say, a resource-intensive game that the kids are playing. I can accept or reject the intrusions with the click of my mouse based on my assessment of whether the intrusion will slow or crash my system.

A second firewall alerts me to intrusions from outside my network — usually the Internet. Again, I can accept or reject these intrusions based on whether they are regular interactions (e-mail, surfing known Web sites), whether I initiated the action (downloading software), or whether some external user or program is trying to search my files (this is how MP3 databanks are created).

These firewalls do not prevent regular interactions because the firewall can be configured to allow certain programs to operate freely within certain confines (I have access to my kids’ computer, but they do not have free access to mine).

Similar firewalls can be established between provincial and federal governments and between governments and external parties. The new panel to mediate health-care disputes between Ottawa and the provinces is similar to the firewall between my computer and the network. It will prevent Ottawa’s unilateral encroachment into provincial health policy — as it should, because the constitutional configuration gives control over health policy to the provinces.

Prior to the establishment of the panel, the federal government reserved the right to punish a province for anything that it deemed to be a violation of the Canada Health Act. In other words, there was no effective firewall to prevent Ottawa from freely invading and changing provincial health policy. This firewall will not prevent mutually beneficial exchanges between Ottawa and the provinces on health care. However, any dispute referred to the panel (the policy equivalent of a pop-up window) gives the province an opportunity to determine whether the intrusion is benign, or whether it might slow or crash the provincial health-care system.

Another example is the Kyoto program. In this case, both federal and provincial firewalls have been active. The federal government has been hesitant to allow the Kyoto program to operate in Canada unless it can get credits for natural gas sold to the United States and elsewhere. The fact that the federal Cabinet appears to be fighting over the mouse does not diminish the fact that firewalls at the federal level are effective at screening policy initiatives from transnational organizations such as the UN, WTO and IMF as well as other nations, particularly the United States.

If Ottawa allows Kyoto past its firewall, the program will face another firewall — a pop-up window will appear in each province. Provinces can accept the intrusion by agreeing to jointly pass legislation to meet the Kyoto commitments. Or provinces can decide that the Kyoto program will result in a less than optimal operation of a province (or even a crash) and thereby refuse to allow it entry. Again, this is as it should be since the Canadian Constitution is configured to give provinces and the federal government joint jurisdiction over environmental policy.

Policy firewalls, like their computer counterparts, will not prevent any and all action on the part of Ottawa if properly (and constitutionally) configured. In the area of interprovincial trade, for example, the constitutional configuration allows Ottawa to freely intrude — the Constitution prohibits barriers to the free flow of goods, services and people across the country. That Ottawa has been reluctant to eliminate attempts to hamper such flows is not an argument against firewalls, but rather reflects a lack of will to work with the current constitutional configuration.

Good policy in a federation like Canada depends on good firewalls. Constitutionally configured firewalls can promote useful interaction between levels of government and the outside world while at the same time providing a useful tool for managing unwarranted or potentially damaging intrusions into domestic or provincial policies. As the recent developments in health-care and Kyoto files illustrate, well-designed policy depends on well-designed firewalls not only between the provinces and Ottawa, but also between Ottawa and the world wide web of governments and other transnational institutions.

Idnumber: 200205030209 Edition: National Story Type: Opinion Note: Ken Boessenkool is president of Sidicus Consulting Ltd., and an Adjunct Research Fellow at the C.D. Howe Institute. Length: 837 words Keywords: FEDERAL PROVINCIAL RELATIONS; HEALTH CARE; GLOBAL WARMING; TREATIES; ARBITRATION; DISPUTES; CANADA

No two professors created equal Calgary Herald Sunday, April 7, 2002 Page: A13 Section: Comment Byline: Ken Boessenkool Source: For The Calgary Herald

An outbreak of junior high Marxism at the University of Calgary’s faculty association may put the future of the U of C, and its substantial contribution to the City of Calgary, at risk.

In a recent newsletter, the association says that the practice of paying market supplements to some professors (and by implication, not others) is “evil.” It wants the practice eliminated with any money saved redistributed equally among all professors.

The trouble is, calling market supplements evil is really no different than calling gravity evil because I fall and skin my knee. For the faculty association can no more suspend the laws of supply and demand in the ivory tower than I can suspend the laws of gravity on my driveway.

The demand for university professors is driven principally by two things. First, there is the demand for a particular skill outside of the academic environment.

This works two ways. Most obviously, this affects disciplines where there is a large market for potential professors outside of the university — things like business professors, applied scientists, engineers, and perhaps economists. In these disciplines, the universities must, in order to attract top-notch talent, recognize the wider job market in setting salaries for their professors.

As a result, salaries in universities should not be on the one-size-fits-all model proposed by the U of C faculty association. If Calgary wants to continue to home-grow top business, scientific, engineering and economic graduates, then these disciplines need access to market supplements to keep these professors from finding work outside of university (or inside another university that will pay them what they are worth).

The second way in which the external demand for a particular skill manifests itself is with respect to the local market for a particular university. For example, Calgary, as a world-class centre for the natural resource industry, has a special need for geologists.

It makes a tremendous amount of sense, therefore, for the U of C to try and attract top-notch academic geologists to teach and do research here.

The average quality of our geology department should be greater than in a comparable university without a similar local need.

This means there is a good reason for the U of C to pay above average salaries to attract top-notch geologists — not just for the benefit of the U of C, but in the interests of the wider community.

The same might be said for political scientists and public policy economists — few cities can match Calgary’s claim of having spawned, and provided the intellectual heft, for a political movement that was the Reform party and is now the Canadian Alliance. If we want to retain that advantage then we may need to provide pay packets in political science and the public policy side of economics that are in excess of the average paid in other disciplines.

The second thing that drives the demand for university professors is the internal ivory tower market for professors.

If, for some reason, there is suddenly a sharp shortage of philosophy professors (perhaps because a bunch of them decide, at the same time, to become the head of their faculty association), then there will be a sudden, perhaps temporary, shortage of philosophy professors. As a result, there may be a need to temporarily pay higher salaries to professors of philosophy in order to ride out this temporary shortage.

A market supplement program is the perfect tool to react to these types of unforeseen circumstances.

In arguing that all professors should have the same basic pay structure the association is denying not just the reality within the ivory tower, but the importance of a university to those with their feet closer to the ground.

Further, allowing the market supplement argument to take place merely between the philosophy department (I think, therefore I should earn the same as you) and the economics department (my marginal product of labour is bigger than your marginal product of labour) within the University of Calgary would be a grave mistake.

Calgary is a world-class city — its quality of life, its business atmosphere, its cultural community — that needs a world-class university.

If the faculty association gets its way, Calgary will not only lose a couple of slightly better- paid academics, it will lose a key ingredient that is critical in making Calgary a world-class city.

If the University of Calgary loses the ability to attract top geologists, top business professors and top political scientists, then it fails to reflect the needs of the community in which it finds itself. And if the people of Calgary — its resource sector, its business community and its political class — fail to register their objections to the proposed elimination of market supplements on which the university relies to best reflect the community in which it operates, then it will have skinned its collective knee.

Idnumber: 200204070085 Edition: Final Story Type: Opinion Note: Ken Boessenkool is an economic and public policy consultant who has studied business, philosophy and economics. He is also a sessional lecturer at the U of C. Length: 810 words Keywords: EDUCATION; UNIVERSITIES; TEACHERS; WAGES & SALARIES; CALGARY Company: UNIVERSITY OF CALGARY Illustration Type: Graphic, Diagram Illustration: Graphic: (See Hardcopy for Illustration)

Alberta leaves parents out of school equation: The people who pay for schools actually want to put their money into something that works. Ken Boessenkool explains. Calgary Herald Thursday, March 7, 2002 Page: A15 Section: Comment Byline: Ken Boessenkool Source: For The Calgary Herald

“Research proves the most effective way to improve student learning is to ensure parents are actively involved in their children’s education.” — Former Alberta Teachers’ Association president,

Bauni Mackay

Given the critical importance of parental involvement, you would think that parents would hold considerable influence over the public education system in Alberta. Unfortunately, just the opposite is true.

The recent meeting between Premier Ralph Klein and Alberta Teachers’ Association President Larry Booi illustrates that in Alberta, the nexus of power in public education lies between the provincial government and the teachers’ union, to the detriment of local school boards, principals and, especially, parents.

Education is not immune to the golden rule — he who controls the gold, rules. In this case, the provincial government ultimately is responsible for funding education and the teachers, though their salaries, receive a lion’s share of that funding. In addition to being the recipient of much of the gold, the ATA’s power is bolstered by the fact that it also controls the certification of teachers — you must be a member of the ATA in order to teach in a public or separate school. This gives the ATA overwhelming power over the direction of education — from teacher training, to deciding what qualifications must be held in order to teach in Alberta.

Local school boards, in contrast, have little control over education because they have lost control over the gold. Even though they formally are responsible for bargaining with the teachers and overseeing local schools, the fact that they do not raise their own revenues to pay for education — as they did when they set local education property tax rates — means that their influence is superceded too easily by a provincial government that has all the golden eggs in its basket.

And because principals are required to be members of the ATA, they cannot be an effective counterweight for parents when that conflicts with the goals of the union.

Lost entirely in the power nexus between the government and the ATA are the parents. Sure, there may be local parent advisory boards and parent councils, but, in practice, because parents do not control the gold, they have little influence over the rules.

The golden rule in private and home schooling works in complete reverse. While the provincial government does provide partial funding for both, a significant share of funding for these forms of education comes from parents.

In contrast with public education, the golden rule in private and home schools means that parents rule. In private schools, it is most often the principal, in concert with parent-driven school boards (or the parents themselves, in the case of home schooling) that determine the composition of the teaching staff, the curriculum and the overall tenor of the school. In other words, the power ranking is parent, principal, school board, teachers and, finally, the province.

And, as you would expect, given the opening quote, private and home schools perform much better than public or separate schools, even when you adjust for socio-economic factors such as education of parents and income.

There are ways to increase parents’ (and principals’ and local school boards’) influence over public education, but many of them are problematic.

We could return taxing authority, for example, to local school boards. This would align much better the gold between parents (who would pay local taxes) and the school. The trouble is, there is a great variation in the ability of different regions to raise property taxes, resulting in great inequities in per-pupil funding across the province.

We also might consider giving the ultimate power to hire and fire school teachers to the principals, and perhaps even require a parent-board to hire the principal — moves that would require principals to be outside of the ATA. But the ATA has been very effective at preventing principals from exiting the union, despite repeated attempts over the past decade.

A third possibility would be to remove the responsibility of the ATA to certify all teachers, giving schools a choice over whether they hire ATA-certified teachers or not. But, again, the golden rule gives teachers enough power in the current system to effectively prevent this change — their withholding of services would weaken the resolve of any government bold enough to try.

But, Alberta, because it already funds choices in education such as charter, private and home schools, is well suited to give power to parents by changing who holds the gold.

Putting gold in the hands of parents, yet retaining a universal education system, could be done by moving to a system of education vouchers. The system would work as follows. Each parent with a school-age child would receive a voucher from the province. That voucher could be used by the parent in any school of their choice, and an equal per-pupil grant would go to that school. A voucher-based system would, therefore, radically increase the importance of parents within our education system, by moving the golden eggs from the province to parents.

Power and control over public education in Alberta is exactly backwards, relegating parents to a minor, if not irrelevant role, and giving most of the power to the government and the teachers union. A voucher system would return to parents the power they deserve over the education of their children. And, that, as the opening quote from the ATA suggests, would be good for everybody.

Ken Boessenkool is the president of Sidicus Consulting Ltd., a Calgary-based economic and public policy consulting firm and an Adjunct Research Fellow at the CD Howe Institute.

Idnumber: 200203070163 Edition: Final Story Type: Opinion Length: 928 words Keywords: EDUCATION; TEACHERS; LABOUR UNIONS; GOVERNMENT POLICY; ALBERTA; PARENTS Illustration Type: Graphic, Diagram Illustration: Graphic: (See Hardcopy for Illustration)

The sixth commandment: the provinces are taking back control of Medicare, and it’s high time Time (Canadian Edition) F 4’02 Page: 37 Byline: Ken Boessenkool Source: The Canadian Index (Magazines) Volume: VOL. 159, NO. 5

Idnumber: 200202040607 Subject: Canada — Federal-provincial relations; Medical care — Laws and regulations Version: CBCA: Fulltext Reference; CBCA: Index

Game theory and military preparedness National Post Wednesday, December 19, 2001 Page: A17 Section: Editorials Byline: James B. Davies and Ken Boessenkool Source: National Post

Those who have ever said to their boss, “If you do that, I’ll quit,” or to their kid “If you do that, you can’t watch TV for a week,” and then backed down when the transgression occurred, will quickly learn the importance of making credible threats. They will also learn that it is especially effective if you can commit to your threatened behaviour in advance. Learning these lessons puts you well on your way to becoming a game theorist.

Game theory is a seemingly arcane and complex branch of mathematics and economics that has, at its core, a solid body of common sense. Canada lays claim to impressive game theorists, occupying positions in our top universities and those of the United States. But we also lay claim to a distinguished group of game players in Ottawa — our federal Liberals.

The Liberals have unique opportunities to hone their game theory skills. As a party that expects to be perpetually in power, they can afford to think ahead not just to the next election, but to the long future over which they expect to reign. Seeing the recent budget as one of these unique opportunities can help explain its otherwise inexplicable character.

In the months since the horrific events of Sept. 11, Canada has joined the United States, Britain and others in an ambitious and apparently successful attempt to root out the terrorists from their home in Afghanistan. While Canadian servicemen and women have contributed to this effort with distinction, our overall military contribution has been small. This has been the inevitable result of the size and limitations of our armed forces, limitations stemming from a long series of budget cuts for the armed forces.

These cuts have resulted in lousy salaries for military personnel; helicopters that aren’t airworthy; transport aircraft that cannot be relied on to make it to the battle zone; and only a few thousand battle-ready soldiers who actually carry guns.

The dismal state of funding of our armed forces was in part the result of the need to trim expenditures in the battle against deficits and debt. The United States under Bill Clinton also substantially reduced expenditures on the military in an effort to get their deficit under control.

In these extraordinary times, however, Ottawa has decided it is necessary to deviate sharply from the course it has charted since 1995 and had reinforced just months ago, when the Finance Minister said that massive new spending would “risk the country’s hard-won victory over deficit financing.” Ottawa charted a new course with a budget that proposes to increase spending by nearly 10% next year, the largest increase in decades. Sept. 11 and its economic aftermath, Mr. Martin now says, make necessary a dramatic about-turn in spending plans.

With such a significant increase in spending, you might expect big dollars for the armed forces to fill the gaps and correct past deficiencies, to say nothing of increasing the size and capacity of our forces. But the budget provides nothing like that. The armed forces are getting only $300-million over and above the direct expenditures incurred to allow them to take part in the war in Afghanistan. This amount represents only 2% of the increased spending promised in the budget, and a fraction of one per cent of total federal program spending.

While inexplicable on its face, game theory can provide an explanation for this pitiful increase.

Suppose (economists’ favourite word after “other” and “hand”) you are the leader of a perpetual party in power in Ottawa. You expect the United States to become engaged in future conflicts, wars and military adventures ranging from small to large. And you realistically expect that either the United States will apply pressure for Canadians to assist in these efforts or Canadians themselves will spontaneously choose to do so.

But suppose, and here’s the kicker, that you are not all that interested in participating in these future efforts. You would prefer to commit yourself to not participating.

Game theory would direct you to resolve this dilemma by limiting the resources allocated to the armed forces. You reduce manpower, expenditures, quality and quantity of equipment as much as the electorate will stand for. When Uncle Sam comes asking for help you can say, “Yes, we’ll give you as much help as we possibly can, keeping in mind our other commitments. We’re sorry we can’t provide more help, but you see, our armed forces are rather small.”

By starving the armed forces, the Liberals can commit to withhold significant future military assistance. The implicit threat is credible and, from a game theory point of view, effective.

That should not be a surprise. If the perpetual party in power in Ottawa decides in advance that it doesn’t really want to help out much on these occasions, not funding the military is just common sense.

Idnumber: 200112190137 Edition: National Story Type: Opinion Note: James B. Davies is a professor of economics at the University of Western Ontario. Ken Boessenkool is president of Sidicus Consulting Ltd. and an Adjunct Research Fellow at the C.D. Howe Institute. Length: 806 words Keywords: POLITICS; GOVERNMENT; ARMED FORCES; BUDGETS; GOVERNMENT SPENDING; CANADA

Ottawa must get off the health care pulpit National Post Saturday, November 17, 2001 Page: A13 Section: Editorials Byline: Ken Boessenkool Source: National Post

In the mid-1990s, National Post’s prolific columnist William Watson wrote he would miss deficits when they were gone. It was a way of pointing out that stultifying inertia would replace the refreshing force of reform once Canadian governments got their fiscal houses in order.

And nowhere is inertia more stultifying than in health care. For the past few years, the drive has been to find more money to push into the health care envelope. That money was not directed toward improving health care delivery or toward reforming our single-payer system. Instead, cash infusions drove up health care inflation via increases in wages to health care providers. Four-fifths of a 14% increase in funding for the regional health authority in Calgary, for example, is going to increased wages and salaries following an obscene 22% province-wide wage increase for nurses.

With the prospect of deficits, the force of reform is returning. The first order of business will be to establish who will drive the debate — Ottawa or the provinces.

During the last bout with deficits, Ottawa accelerated its three-decades long retreat from the health care field when the 1995 budget proposed to reduce cash contributions to health by 40%. This made sense at just about every level, for there is no real reason for Ottawa to be involved in the evolution of health care in Canada.

The provinces, not Ottawa, administer health care programs. Ottawa, generally, does not run hospitals, pay nurses or bargain with doctors. It does not design payment mechanisms or decide which services should be funded. All it has is a bully pulpit based on the Canada Health Act and the stick of financial penalties under cash transfers to the provinces.

Ottawa makes political use of its pulpit and penalties, which results in confusion about which government is responsible for health care. This confusion is not costless: It allows the provinces to shift the blame to Ottawa when it makes mistakes, and allows Ottawa to claim credit for reforms it had nothing to do with. Ottawa’s cash transfers also mean provinces do not have to bear the full tax cost of health care spending — particularly in recent years, as the provinces have allowed (nay, begged) the feds to play a bigger financing role.

From an economic point of view, there are no interprovincial issues that warrant national oversight. User fees in Alberta will not affect the health of people in Saskatchewan. Agreements between provinces already address the issue of border crossers — a person carrying an Alberta Health Care card into a Saskatchewan hospital will trigger payments between the two governments.

There are real advantages to allowing provinces to design health care systems that differ across provincial boundaries. Just as competition in the private markets results in greater innovation, so does competition between provinces allow for experimentation and a better alignment of health care to the desires of electorates.

Contrary to Canadian health care mythology, there is no single Canadian health care system. Services covered in some provinces are subject to user fees in others (abortions, for example). Some Canadians pay health care premiums, while others do not. Private hospitals have been allowed to operate in some provinces (Ontario, B.C.), but not in others.

Only Ottawa’s pulpit and penalties stand in the way of new experiments. If the people of Ontario wish to allow higher income individuals to take the strain off the system by purchasing health care without travelling to the United States, they should be allowed to do so. If Alberta wishes to implement co-payments for certain services through a medical savings account funded by health care premiums, it should do so. If the people of Saskatchewan wish to have every possible service, including home care and pharmaceuticals, paid for by the government and are willing to pay the required taxes, they should do so.

The remaining provinces could then observe these experiments and decide which model they like.

This experimentation will take boldness on the part of provincial governments. To win the health care debate, they might consider paying up-front penalties to Ottawa for reforms outside the health act. Those penalties should reflect the relative size of Ottawa’s contribution to health — so if a province charges $100-million in user fees, it would pre-pay a $13-million penalty to reflect the fact Ottawa’s contribution is 13% of the cost of provincial health care.

In the longer term, provinces should rally around the idea that Ottawa should replace its distorting cash transfers with additional tax room for the provinces to fund health. This tax room will enter the equalization formula, so all provinces would get similar amounts to fund health care demands. The provinces might even consider allowing Ottawa to keep some of this additional money as a contribution toward national security.

Canada’s last bout with deficits produced some refreshing health care reforms: Ottawa reduced its role, most provinces restructured or regionalized their delivery systems; and a debate over the sustainability of our single-payer system began. The reform initiative receded when money became plentiful. The sense of reform is now returning, mainly because governments are facing the prospects of fiscal deficits.

These deficits are, therefore, welcome, but only in a Watsonian kind of way.

Idnumber: 200111170171 Edition: National Story Type: Opinion Note: Ken Boessenkool is president of Sidicus Consulting Ltd., a Calgary based economic and public policy consulting firm, and an Adjunct Research Fellow at the C.D. Howe Institute. Length: 867 words Keywords: FEDERAL PROVINCIAL RELATIONS; HEALTH CARE; GOVERNMENT SPENDING; RESTRUCTURING; MANAGEMENT; CANADA

Security is Ottawa’s Job 1 National Post Thursday, October 18, 2001 Page: A17 Section: Editorials Byline: Ken Boessenkool Source: National Post

Ottawa has been widely criticized for a sluggish response to the events of Sept. 11. While the recent bill on terrorism sparked positive reviews, the rush and admitted lack of preparedness surrounding it is worrying. Many reasons can be cited for this sluggishness, but key among them is that for too long Ottawa has neglected the core functions of what a national government ought to do.

Before Sept. 11, the most important cabinet posts in Ottawa were thought to be Finance, Health, Industry and Human Resources Development and, perhaps, Foreign Affairs. This is where the major contenders for leadership of the Liberal party were found, though Foreign Affairs has in the past been viewed as a political capstone rather than a stepping stone.

After Sept. 11, the ranking shifted — Health, Industry and Human Resources were bumped by Defence, Justice, Solicitor General and Immigration. The spotlight on these core national functions reveals that they have been suffering what might at best be called benign neglect.

It is no secret Canada long has been a target and a base for actual and suspected terrorists. CSIS briefings have become ever more clear, and specific, on the risks Canada faces — 350 individuals and 50 organizations have been on their target list. If these warnings are not enough, as early as 1999 the infamous Ahmed Ressam case laid bare Canada’s national security vulnerabilities. And benign neglect is too friendly a term to describe the treatment of our military over the past few decades.

This lack of focus is analogous to the situation large, private-sector firms find themselves in when they stray outside their core competencies to get in on the next big thing. When senior management’s attention is diverted, too often core competencies — often the source of revenue needed to pursue the next big thing — suffer a similar neglect, and profits suffer.

Such firms can return to profitability by using a number of different strategies. One is to split the company into core units, each with its own autonomous management team, as Canadian Pacific has recently done. Other firms opt for a higher risk strategy of shifting their core competency to the new product or service line. A third, and more common strategy is to return to basics. Moore Corp. is a recent example of a company returning to its core competencies.

Ottawa could pursue a version of the first strategy by shuffling its key cabinet ministers into its core areas. Defence would be a stepping stone portfolio like health, rather than the tombstone portfolio it has unfortunately become. Having a key minister at the helm matters, as the current Minister of Foreign Affairs has demonstrated in recent weeks. But the federal government is ultimately ruled by a single Prime Minister from a single party. It is easy to envision Ottawa straying, as it has in the past, in the face of political or public pressure. Benign neglect of national security is too easy when Canadians have health care on their minds.

Shifting entirely out of national security is not tenable, as there is no replacement for our federal government in these matters, and relying more than we already do on the United States would compromise our identity as a nation.

Ottawa should therefore go back to basics. This means scaling down or eliminating its presence in non-core areas. The easiest big-ticket areas would include health care, post-secondary education, welfare and labour market programs — all provincial areas of responsibility where provinces do most of the heavy lifting. Other possibilities are unemployment insurance and the child tax benefit.

On health, post-secondary education and welfare, Ottawa should eliminate transfers to the provinces, and allow provinces to raise their own taxes to fund these programs. Equalization would ensure adequate revenue for all provinces. Ottawa should also fulfill the obligation it made in 1995 to get out of labour market programs — including the 40% of unemployment insurance spending that is not insurance against unemployment. Devolving unemployment insurance and the child tax benefit programs to the provinces would require a bit more spadework. Giving unemployment insurance to the provinces might require a constitutional amendment. But devolution of the program holds out the potential of removing its regional inequities — and unemployment insurance cash flows have provided an excuse to Ottawa to worsen these inequities. Provincializing the program would also allow provinces to better align their unemployment insurance and labour market programs. As for the child tax benefit, it is better thought of as Ottawa’s contribution to provincial welfare schemes — with the attendant overlap. Besides, many provinces have their own child tax credits. Provincial child benefits that are integrated with provincial welfare programs makes sense.

A back-to-basics approach would give national security the attention it deserves — both at this time of heightened concern, and in the future. If Finance, Foreign Affairs, Defence, Justice, Solicitor General and Immigration had been properly treated as the core competencies of our federal government before Sept. 11, it is hard to imagine our response would have been so sluggish. After all, there would probably have been leadership ambitions on the line.

Idnumber: 200110180121 Edition: National Story Type: News; Crime; Opinion Note: Ken Boessenkool is a Calgary economist and an Adjunct Research Fellow at the CD Howe Institute. Length: 852 words Keywords: GOVERNMENT; TERRORISM; SECURITY; LAWS AND REGULATIONS; GOVERNMENT SPENDING; CANADA

Beware of Grits bearing gifts Calgary Herald Friday, August 24, 2001 Page: A25 Section: Comment Byline: Ken Boessenkool Source: For The Calgary Herald

Albertans are currently witnessing the spectacle of federal cabinet ministers liberally sprinkling dollars across our province. And while the attention may be welcome, the unfortunate reality is that each new dollar Ottawa doles out costs Albertans at least 35 cents.

If Ottawa wanted to spend a new dollar on each and every Canadian, by, say, increasing transfers to the provinces for health care, it needs first to raise the revenues (something politicians like to forget). And it is in the raising of the revenues that Alberta gets the short end of the stick.

If Ottawa raised personal income taxes to get the money for this new transfer, the C.D. Howe Institute calculates it would do so by raising about $1.35 in Alberta and Ontario, just over a buck in British Columbia, and only 67 cents from residents in all other provinces.

This is because personal incomes in Alberta and Ontario are much higher than in all other provinces, so any personal income tax rate levied across Canada brings in more revenues from these provinces.

So, even if Ottawa sends an equal per capita cash transfer to each Canadian, this transfer would actually cost Albertans and Ontarians (and to a lesser extent British Columbians) more than it would bring in. This math makes plain the peculiarity of Mike Harris’s recent campaign to get more federal dollars for health. Each additional health dollar Harris asks for would cost Ontario residents 35 cents. Ditto for Alberta.

And that’s the best-case scenario. It gets worse when the largesse spread around by Ottawa is not spent equally among provinces. Which takes me back to the current Liberal dusting of Alberta with cash.

Many of the projects in the recent announcement-per-day-blitz are the kind of programs where Alberta rarely sees its share — things like research dollars, job training assistance and federal infrastructure dollars.

For example, when it comes to training programs offered under the Employment Insurance program, Alberta sees only 66 cents on the dollar.

The result is that, while on the revenue side Alberta is giving Ottawa $1.35 and the poorer provinces are giving 67 cents, on the spending side, Alberta is all too often getting the 67 cents and the poorer provinces the $1.35.

This works out to a net loss of 68 cents because we get only half of what we are paying. This makes little sense in a country that has a program that explicitly redistributes money across provinces — the federal equalization program.

Equalization calculates the ability of all provinces to raise revenues, and Ottawa shuffles money around to bring the poorer provinces up to a representative average.

Ottawa’s goal in spreading cash around Alberta might therefore be read not as a vote-getting exercise, as some have said, but as an attempt to justify continued extravagance elsewhere. How then, should Alberta respond to this gift that keeps on taking?

Alberta should, as it does, acknowledge the importance of providing all provinces with an equitable base from which to fund their programs. But beyond this, it should demand that federal expenditures outside of equalization treat all Canadians equally.

Much better would be a polite refusal to take the money in the first place — with the caveat that we would gladly exchange less federal spending in return for more tax cuts. That way we can keep the money and manage programs such as training, infrastructure and health, closer to home. And, this would not rob poorer provinces, as equalization would continue to provide them with an equitable revenue stream.

By making these tax and spending decisions in provincial capitals rather than in Ottawa, the programs are much more likely to be tailored to the needs of our diverse provincial economies and the desires of the provincial populations.

This is not just true for the three “have” provinces of Alberta, Ontario and British Columbia — after all, is it really believable that Ottawa has done a better job managing the fisheries than the Atlantic provinces could have done?

Best of all, when the Alberta government spends a dollar, it only costs Albertans one dollar.

Ken Boessenkool is a Calgary economist and Adjunct Research Fellow at the C.D. Howe Institute.

Idnumber: 200108240123 Edition: Final Story Type: Business; Opinion Length: 697 words Keywords: FEDERAL PROVINCIAL RELATIONS; CANADA; ALBERTA; FINANCES, GOVERNMENTAL

The case for overhauling equalization payments The Telegram (St. John’s) Monday, August 13, 2001 Page: A6 Section: Editorial Byline: Ken Boessenkool and Brian Lee Crowley Source: Special to The Telegram

The current debate on Ottawa’s equalization payments to economically disadvantaged provinces is not primarily, as Intergovernmental Affairs Minister Stephane Dion asserted in the Globe and Mail a few days ago, about special treatment or about disincentives that the program creates for recipient provinces — as worthy as these topics are for discussion. The real debate is about the proper role of nonrenewable resources within the equalization program.

Resource revenues have been a constant trouble spot for equalization. When equalization was created in 1956, the formula excluded resource revenues. Half of resource revenues were added in 1962, and for the next 20 years Ottawa fiddled with the treatment of resource revenues eight times.

In 1982, Ottawa moved to a five-province standard, excluding Alberta, and hence its resource revenues, from the calculation of payments to recipient provinces. More recently, Ottawa has further tinkered with the resource formula to try to reduce its disincentive effects on the provinces. Finally, as Dion’s piece stated, Ottawa has created a number of cash transfers into the Atlantic region (Hibernia, various development funds) to offset the impact of falling equalization payments as resource royalties grew.

There is a good explanation as to why resource revenues have never quite fit properly within the equalization formula — nonrenewable resource royalties are of a fundamentally different nature from other types of revenues.

An accounting illustration provides the backdrop. The revenue from bread that Bill the baker sells is income — it affects the profits and losses of the bakery.

However, if Bill sells one of his ovens, the money from that sale does not enter the income statement. This sale is a balance sheet transaction. (This is a simplification: interest on the cash from the sale may later enter the income statement, replacing the depreciation that existed before.)

Taxes on personal and corporate income, as well as sales, are like revenue from the sale of bread. They are properly considered income for the purposes of providing public services.

Nonrenewable resource royalties are quite different. According to the Canadian Constitution, the provinces own these resources. (While offshore resources legally belong to the federal government, Ottawa has granted de facto ownership to Nova Scotia and Newfoundland by allowing them to collect all the royalties.)

When these resources are sold and a royalty is levied on that sale, all that changes is that the province now has a cash asset instead of an asset in the ground.

The trouble is, equalization does not make the distinction between income and the proceeds from the sale of a capital asset. It treats royalty revenues the same as it treats personal, corporate and sales taxes. Equalization payments fall in response to changes in royalties even though all the province has done is convert a physical asset into a financial asset.

The flip side to this argument is that it matters what Nova Scotia or Newfoundland does with the proceeds from the sale of the capital asset. For if royalties represent the conversion of an asset in one form to another, the resulting cash should not be used to pay for current program spending (just as it would be unwise for Bill the baker to spend the proceeds of the sale of his oven on paying wages for his staff). In the case of the Atlantic provinces, this cash should be used to either reduce debt, or invest in long-term infrastructure.

Which is arguably what Alberta did with its royalties in the 70s and 80s when it diverted some of this money into the Alberta Heritage Savings Trust fund. Today, Alberta is using resource revenues to pay down its debts and increase infrastructure spending to accommodate the rapid financial and physical net immigration to Alberta.

It is our view that voters in Atlantic Canada should decide on the proper use of the proceeds from the sale of their capital assets, and that these assets should not be seized via the equalization back door by Ottawa. The critical point is that the sale of the asset itself should not affect the income statement — or fiscal capacity in the terminology of equalization buffs — of the provinces.

The elimination of nonrenewable resources from equalization will mean provinces can use these financial assets to improve the economic outlook of the provinces — which in turn will reduce their reliance on equalization as Ottawa reduces payments in response to the resulting growth in personal, corporate and sales tax revenues. This is precisely how once-poor Alberta escaped an earlier variant of equalization.

By removing nonrenewable resources from equalization, Ottawa has a chance to get out of the way and let Nova Scotia and Newfoundland make a success of their own natural economic strengths. This would be both a more equitable, as well as a more economically defensible, position. It would meet Dion’s goals of ending special treatment, making the program more equitable, and it would also improve economic incentives — a public policy hat-trick all too rare in the arcane world of equalization.

Idnumber: 200108130047 Edition: Final Story Type: Opinion Note: Ken Boessenkool is the Calgary-based author of Taking off the Shackles: Equalization and the Development of Natural Resources in Atlantic Canada, published last month by the Atlantic Institute for Market Studies (AIMS). He was recently named an adjunct research fellow of the C.D. Howe Institute. Brian Lee Crowley is the president of AIMS. Length: 832 words

On health, provinces should go it alone National Post Monday, July 30, 2001 Page: A15 Section: Editorials Byline: Ken Boessenkool Source: National Post

The story of a repeatedly jilted lover who, with vain hope, returns again and again to his partner is tragically familiar. Just as familiar as, say, provincial governments asking Ottawa for additional dollars for health care.

In the beginning of the storied relationship on health funding between the federal government and the provinces, the provinces vowed to provide universal public health and Ottawa vowed to fund half the cost. Ottawa’s funding took various forms, from cash transfers to lowering federal taxes so provinces would have more “tax room” to fund health care (a transfer of “tax points” to the pointy-headed crowd).

The early signals of Ottawa’s unfaithfulness were innocent enough — it changed the calculation of cash transfers by including provincial revenues that were the result of the tax point transfer. But the sideways glances soon became more overt. Having promised this tax room to the provinces, Ottawa proceeded to take it back with a series of tax increases. Ottawa’s cash contribution therefore declined in line with provincial growth while at the same time its total tax take was higher than it was prior to the transfer of tax points.

Ottawa’s successful flirtations lead to an increased boldness. It reneged on the vow to cover half of health spending, but still used growing tax points to offset the cash payable to make up the smaller total. By the time the Chretien Liberals took office, the combination of caps, and continuing to count the tax points as part of their contribution, drove Ottawa’s cash contribution down to 17% of health care spending.

Ottawa stopped using tricks to sidestep its vow with the 1995 budget announcement that total transfers for health, education and welfare would drop from $18.3-billion to $11-billion over the next few years. At this point, any self-respecting counsellor would have advised the provinces to cut their losses, and stop pretending that Ottawa should have a meaningful role in the funding of health. Better, the counsellor would have suggested, that provinces strike out on their own and think of other creative ways of funding health care.

But no, like the jilted lover, the provinces began an annual pilgrimage to try and patch things up. Ottawa occasionally relented, but not without further reducing the self-respect of the provinces from time to time. Ottawa’s most offensive move came in 1998 when it gave up a few extra dollars for health in return for nine signatures on the Social Union Accord, an accord that allowed Ottawa much freer rein to intervene in other areas of provincial jurisdiction. Only Quebec reversed the humiliation — it refused to sign the Social Union Accord, but still took the money.

Quebec is also one of only two provinces (Alberta is more quietly the other) that occasionally proposes a clear path back to self-respect — a greater degree of separation between Ottawa and the provinces on health care. And what better way to facilitate this separation than to ask Ottawa to provide additional tax room to the provinces to fund their own health care needs. Getting there needn’t require a full blown, 10-signature national accord.

All the provinces need to do is change their request from $7-billion dollars in additional federal cash transfers to $7-billion in new federal tax cuts. For if Ottawa cut its taxes by $7-billion, provinces could then use this additional room (admittedly by raising their tax rates) to fund health care while keeping the tax burden on Canadians constant.

This proposal has two other side benefits. First, Canada’s poor provinces would have access to just as much tax room as the rich provinces, because the equalization formula would include the additional tax room provinces used to fund health care.