Until this morning, the Bank of Canada appeared to be succeeding in the hard but necessary job of limiting the impact of the weak Canadian dollar on monetary policy, focusing instead on the outlook for growth and inflation in the Canadian economy. The Bank’s longstanding but misleading policy guide, the monetary conditions index — which made the exchange rate a key determinant of interest rate policy — seemed at long last to have been buried. Now, however, the one-percentagepoint hike in the Bank Rate shows that the index still rules from the grave. Worse, it threatens to drag the Canadian economy under with it. If not reversed shortly, this latest rate hike all but guarantees a recession by year-end.

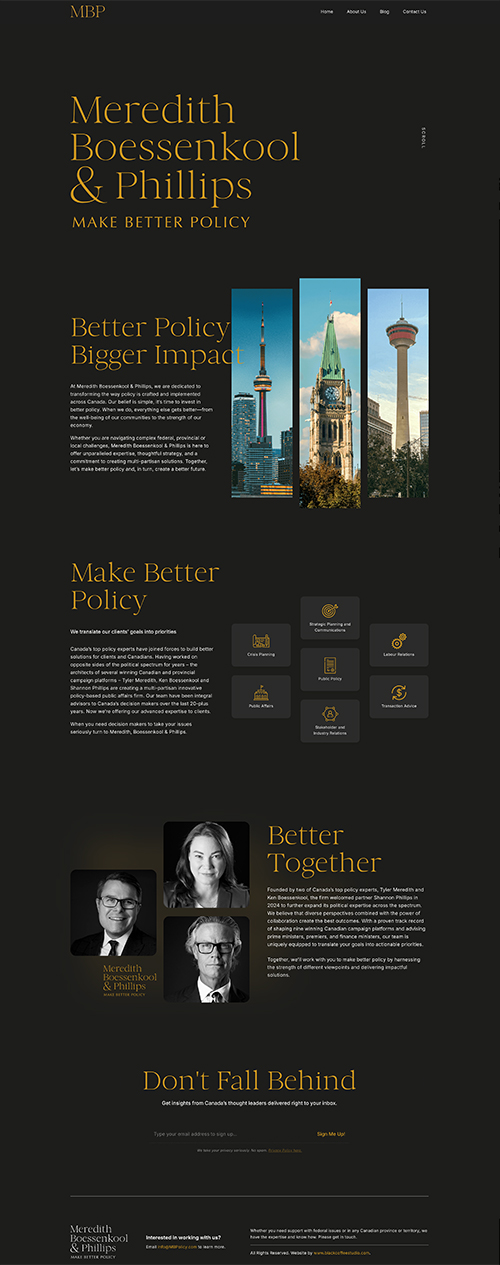

Meredith Boessenkool & Phillips

I’m pleased to announce that Shannon Phillips has joined forces with myself and Tyler Meredith, creating Meredith Boessenkool & Phillips. Together we’ll offer our brand of innovative policy-based expertise to Canadians from coast to coast.

We work to translate our clients’ goals into public policy priorities, crafting ready-made, comprehensive solutions for government.

To Make Better Policy with Meredith Boessenkool & Phillips, visit MBPolicy.com.

Ken

Buried by a Falling Dollar: The Bank of Canada’s Misguided Interest Rate Hike Promises Recession